Asset allocation calculator by age

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. Subtract your age from 100 to determine what percentage of your portfolio you should hold in stocks.

Fire Calculator When Can I Retire Early Engaging Data

This tool will suggest an asset allocation for you across different asset classes based on your level of risk capacity and risk tolerance.

. And it explains how the. The asset allocation is designed to help you create a balanced portfolio of investments. Using age minus 20 for bond allocation a starting age of 20 and a retirement age of 60 a one-size-fits-most.

Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Ad Six Risk-Based Portfolios to Target a Range of Return and Risk Objectives. Ad PIMCO Has Been Helping Investors Achieve Their Goals For More Than 50 Years.

Our Resources Can Help You Decide Between Taxable Vs. College Savings Calculator 529 Savings Plan. The old rule of thumb used to be that you should subtract your age from 100 - and thats the percentage of your portfolio that you should keep in stocks.

Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. Age-based asset allocation makes certain assumptions about various ages and life stages. Your current Age Years 46-60 yrs 21-30 yrs 31-45 yrs.

So a 30 year-old would allocate 70 percent of their portfolio to stocks and a 70 year-old would allocate 30 percent of their portfolio to stocks. Modifications to the recommendations may. If you were born between 1943 and 1954 for example your FRA is 66.

Your age ability to tolerate risk and several other factors are. Ad Learn More About American Funds Objective-Based Approach to Investing. Ad Learn More About American Funds Objective-Based Approach to Investing.

Your age ability to tolerate risk and several other factors are used to calculate a desirable mix of stocks. Asset Allocation Calculator Canadian The asset allocation is designed to help you create a balanced portfolio of investments. Asset allocation is designed to help you create a balanced portfolio of investments.

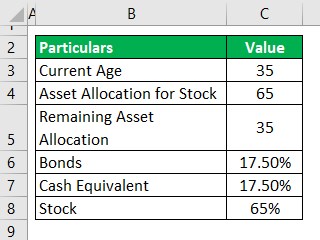

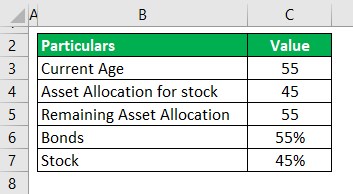

A balanced portfolio is the key to success in the world of investments and this tool will help you allocate your savings and assets more productively. The rule of 100 for asset allocation follows a simple premise. Asset Allocation Calculator is a ready-to-use tool that you can use to get an appropriate asset allocation.

Ad Contact Us to Learn More About How Our Capital Allocation Services Can Help. Asset Allocation Calculator Asset Allocation Tool helps investment in Asset Allocation Fund and decide Asset Allocation Startegies. The Asset Allocation Calculator from 7 17 Credit Union can help you find the mix of investments that will help you reach your savings goals.

You need to enter your current age level of risk you can. The Asset Allocation Calculator is designed to help create a balanced portfolio of investments. Asset Allocation Calculator Allocate The Assets Using.

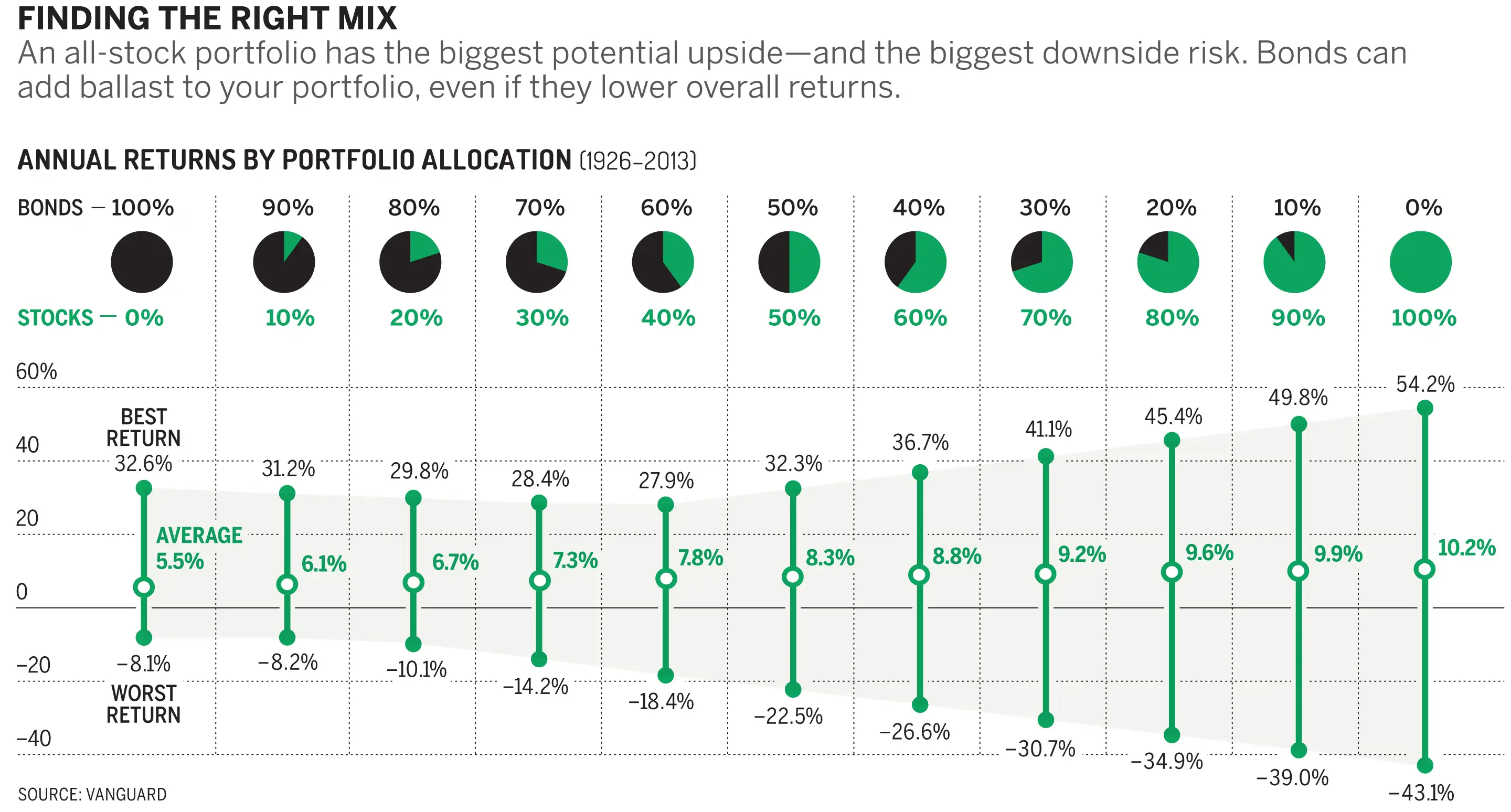

Build Your Future With a Firm that has 85 Years of Investment Experience. Simple asset allocation calculator that provides guidance concerning approximate equity and fixed income exposure based on age. By comparison people over age 55 only hold about 66 of their assets in stocks.

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. Download our free guide to learn to get the most out of your retirement funds. Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home.

If youre in your 20s or 30s its generally assumed that you can take more risk. In fact this age group allocates nearly 90 of their portfolio to them. Crafted by Experts and Designed to Capitalize on Ever-Changing Markets.

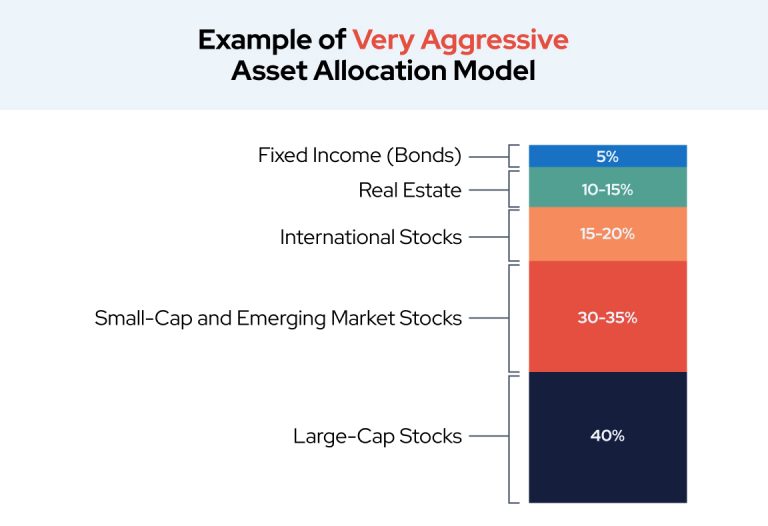

Lets look at some examples of asset allocation models by age. Your age ability to tolerate risk and several other factors are used to calculate a. Delivering Better Decisions Accelerated Results - From Idea to Implementation.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Thus the older you get the less. Using scientific principles this calculator computes the age at which your pre-retirment contributions should be sufficient to meet your retirement needs.

Based on your age risk tolerance. Leverage Our Time-Tested Investment Process And Active Management Expertise. How to Calculate Using Asset Allocation Calculator.

Ad Download this must-read guide about retirement income from Fisher Investments.

Proper Asset Allocation Of Stocks And Bonds By Age New Life Financial Samurai Stocks And Bonds How To Get Money Bond

The Proper Asset Allocation Of Stocks And Bonds By Age

Recommended Net Worth Allocation By Age And Work Experience

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Asset Allocation Spreadsheet Excel Template White Coat Investor

I Am 30 Years Old What Should My Ideal Asset Allocation Be Investeek

Asset Allocation The Ultimate Guide For 2021

What Is Asset Allocation How Is It Important In Investing

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

Asset Allocation The Ultimate Guide For 2021

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

This Is The Right Amount Of Stocks To Own At Every Age Money

The Proper Asset Allocation Of Stocks And Bonds By Age

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

The Proper Asset Allocation Of Stocks And Bonds By Age