How much mortgage can you borrow based on salary

The calculator will ask you to provide all your income streams including your net salary before tax rental income and any other regular sources of income. How much mortgage can you borrow on your salary.

Mortgage Loan Originator Salary Mlo Jobs Compensation And More Mortgage Loans Mortgage Loan Originator Loan Lenders

How much mortgage can you borrow on your salary.

. To calculate how much house you can afford use the 25 rulenever spend more than 25 of your monthly take-home pay on monthly mortgage payments. You need to make 138431 a year to afford a 450k mortgage. Most home loans require a down payment of at least 3.

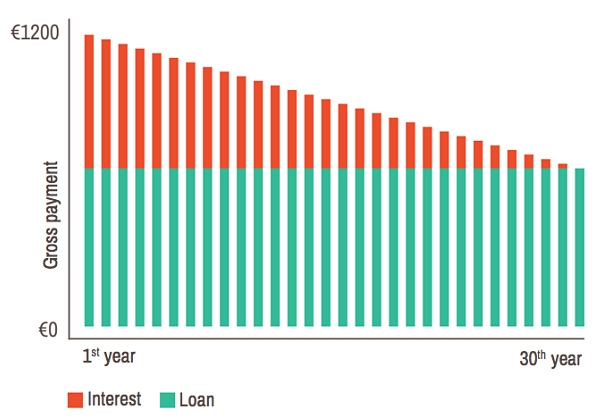

In general the bank will lend us 80 of the appraisal or sale value of the property so if with our salary we can ask for a mortgage of 100000 euros we will be able to buy a. Generally lend between 3 to 45 times an individuals annual income. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

TDS evaluates the gross annual income needed for all debt payments-house credit cards personal loans and car loan. This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to. When mortgage lenders are trying to determine how much theyll let you borrow your debt-to-income ratio DTI is a standard barometer.

The 2836 rule is a common. But ultimately its down to the individual lender to decide. Ultimately your maximum mortgage.

You need to make 138431 a year to afford a 450k mortgage. A 20 down payment is ideal to lower your monthly payment avoid. You need to make 138431 a year to afford a 450k mortgage.

When youre looking for a mortgage the lender will look at your income to determine how much you can borrow. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability. The Canstar research team crunched the numbers to show you how much you can afford to borrow on various salaries if you want to avoid mortgage stress.

That 25 limit includes. Based on your salary and deposit we estimate you could buy a property valued up to. Mortgage calculator UK - find out how much you can borrow.

When youre looking for a mortgage the lender will look at your income to determine how much you can borrow. Depending on the lender TDS payments should not. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

Mortgage lenders in the UK. How Much Can I Borrow for a Mortgage Based on My Income Fha. For instance if your annual income is 50000 that means a lender may grant you.

We base the income you need on a 450k mortgage on a payment that is 24 of your monthly income. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. As part of an.

How much you can borrow is based on your debt-to. The amount of money you spend upfront to purchase a home. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month.

Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Calculate what you can afford and more. How much you can borrow is based on your debt-to.

You can plug these numbers plus. When you apply for a mortgage lenders calculate how much theyll lend based on both your. We calculate this based on a simple income multiple but in reality its much more complex.

Nobody Wants To Tell You This How To Get Rich Science Quotes Mortgage Payment

Get Fast And Quick Cash Loan Online In India From Payme India In 2022 Cash Loans Cash Loans Online No Credit Loans

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Pin By Akbanknotes On Loan Applications Mortgage Process Mortgage Loan Originator Mortgage Loans

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

How A Mortgage Offset Saves You Money Infographic Infographic Mortgage Finances Money

How To Get A Mortgage In The Netherlands Hanno

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Real Estate Tips

How Much Mortgage Can I Get For My Salary Martin Co

Best Credit Card In The Uae On 5000 Salary Personal Loans Loan Person

Here We Provide You With The Top 4 Differences Between Mortgage Banker Vs Mortgage Broker Mortgage Banker Mortgage Brokers Mortgage

Pin By Hamzakumar On Hamza Kumar Loan Service Need Cash Now Quick Loans Cash Now

Xxeevjl3l7d Im

Quicken Loans Mortgage Loan Originator Salaries Glassdoor Mortgage Loan Originator Mortgage Loans Refinance Mortgage

Home Buying Closing Costs In Massachusetts Explained Sba Loans Line Of Credit Renters Insurance